what adjustment is made to record the estimated expense for uncollectible accounts?

Accounting for Receivables

53 Business relationship for Uncollectible Accounts Using the Residue Canvas and Income Statement Approaches

You lend a friend $500 with the agreement that you will be repaid in 2 months. At the end of ii months, your friend has non repaid the money. Y'all continue to request the money each month, but the friend has yet to repay the debt. How does this bear on your finances?

Retrieve of this on a larger scale. A depository financial institution lends money to a couple purchasing a home (mortgage). The understanding is that the couple will make payments each month toward the principal borrowed, plus interest. Equally fourth dimension passes, the loan goes unpaid. What happens when a loan that was supposed to be paid is non paid? How does this touch the fiscal statements for the bank? The bank may demand to consider ways to recognize this bad debt.

Fundamentals of Bad Debt Expenses and Allowances for Doubtful Accounts

Bad debts are uncollectible amounts from customer accounts. Bad debt negatively affects accounts receivable (see (Figure)). When future collection of receivables cannot be reasonably assumed, recognizing this potential nonpayment is required. There are two methods a company may use to recognize bad debt: the straight write-off method and the allowance method.

Bad Debt Expenses. Uncollectible customer accounts produce bad debt. (credit: modification of "Past Due Bills" by "Maggiebug 21"/Wikimedia Eatables, CC0)

The direct write-off method delays recognition of bad debt until the specific client accounts receivable is identified. Once this account is identified as uncollectible, the company will record a reduction to the customer's accounts receivable and an increase to bad debt expense for the exact corporeality uncollectible.

Under generally accepted accounting principles (GAAP), the directly write-off method is not an acceptable method of recording bad debts, because it violates the matching principle. For example, presume that a credit transaction occurs in September 2018 and is determined to be uncollectible in February 2019. The direct write-off method would record the bad debt expense in 2019, while the matching principle requires that information technology be associated with a 2018 transaction, which will better reflect the relationship betwixt revenues and the accompanying expenses. This matching outcome is the reason accountants will typically use one of the two accrual-based bookkeeping methods introduced to business relationship for bad debt expenses.

It is of import to consider other bug in the treatment of bad debts. For instance, when companies account for bad debt expenses in their financial statements, they volition use an accrual-based method; however, they are required to use the direct write-off method on their income tax returns. This variance in treatment addresses taxpayers' potential to manipulate when a bad debt is recognized. Because of this potential manipulation, the Internal Revenue Service (IRS) requires that the straight write-off method must exist used when the debt is determined to be uncollectible, while GAAP still requires that an accrual-based method exist used for financial accounting statements.

For the taxpayer, this ways that if a company sells an detail on credit in October 2018 and determines that information technology is uncollectible in June 2019, it must show the effects of the bad debt when information technology files its 2019 tax return. This application probably violates the matching principle, just if the IRS did not take this policy, in that location would typically exist a significant amount of manipulation on company tax returns. For example, if the company wanted the deduction for the write-off in 2018, information technology might claim that it was actually uncollectible in 2018, instead of in 2019.

The final point relates to companies with very little exposure to the possibility of bad debts, typically, entities that rarely offering credit to its customers. Assuming that credit is not a pregnant component of its sales, these sellers tin can also use the direct write-off method. The companies that qualify for this exemption, however, are typically small and non major participants in the credit market. Thus, almost all of the remaining bad debt expense cloth discussed here will be based on an allowance method that uses accrual accounting, the matching principle, and the revenue recognition rules under GAAP.

For example, a customer takes out a $xv,000 car loan on August 1, 2018 and is expected to pay the amount in full earlier Dec 1, 2018. For the sake of this example, presume that there was no interest charged to the heir-apparent because of the curt-term nature or life of the loan. When the business relationship defaults for nonpayment on December i, the visitor would record the following journal entry to recognize bad debt.

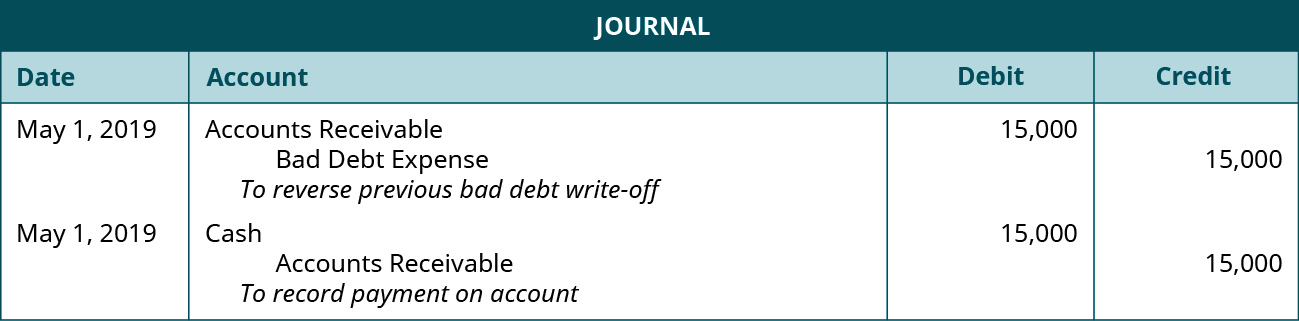

Bad Debt Expense increases (debit), and Accounts Receivable decreases (credit) for $xv,000. If, in the future, any role of the debt is recovered, a reversal of the previously written-off bad debt, and the collection recognition is required. Let's say this customer unexpectedly pays in full on May 1, 2019, the company would record the following periodical entries (note that the company's fiscal year ends on June xxx)

The first entry reverses the bad debt write-off by increasing Accounts Receivable (debit) and decreasing Bad Debt Expense (credit) for the corporeality recovered. The 2nd entry records the payment in total with Cash increasing (debit) and Accounts Receivable decreasing (credit) for the corporeality received of $xv,000.

Every bit yous've learned, the delayed recognition of bad debt violates GAAP, specifically the matching principle. Therefore, the direct write-off method is not used for publicly traded company reporting; the assart method is used instead.

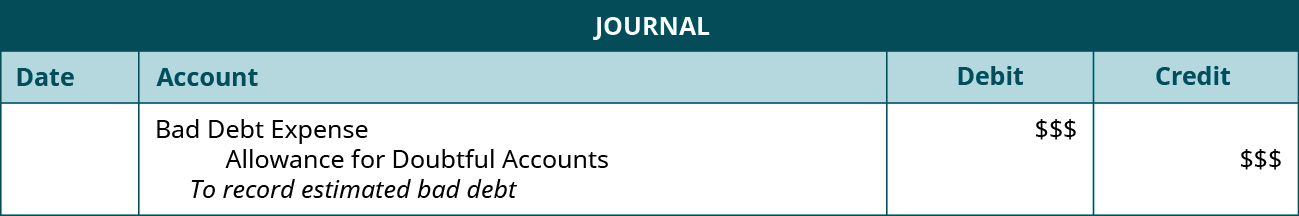

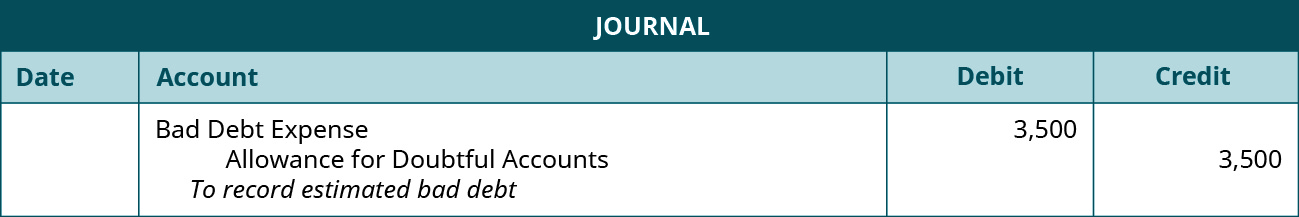

The allowance method is the more widely used method because it satisfies the matching principle. The allowance method estimates bad debt during a period, based on certain computational approaches. The calculation matches bad debt with related sales during the period. The estimation is made from past feel and industry standards. When the estimation is recorded at the end of a menstruum, the following entry occurs.

The journal entry for the Bad Debt Expense increases (debit) the expense's balance, and the Allowance for Doubtful Accounts increases (credit) the residuum in the Assart. The allowance for doubtful accounts is a contra asset business relationship and is subtracted from Accounts Receivable to make up one's mind the Internet Realizable Value of the Accounts Receivable account on the balance sheet. A contra account has an opposite normal balance to its paired account, thereby reducing or increasing the balance in the paired account at the end of a period; the adjustment can exist an improver or a subtraction from a controlling account. In the instance of the allowance for doubtful accounts, it is a contra account that is used to reduce the Controlling business relationship, Accounts Receivable.

At the end of an accounting period, the Assart for Doubtful Accounts reduces the Accounts Receivable to produce Internet Accounts Receivable. Note that allowance for doubtful accounts reduces the overall accounts receivable account, not a specific accounts receivable assigned to a customer. Because information technology is an interpretation, it ways the exact account that is (or will get) uncollectible is non yet known.

To demonstrate the treatment of the allowance for doubtful accounts on the balance canvas, assume that a company has reported an Accounts Receivable rest of $90,000 and a Balance in the Assart of Hundred-to-one Accounts of $4,800. The following table reflects how the relationship would be reflected in the current (curt-term) department of the company's Residue Sheet.

There is one more than point about the use of the contra account, Allowance for Doubtful Accounts. In this example, the $85,200 total is the net realizable value, or the amount of accounts anticipated to be nerveless. However, the company is owed $90,000 and will still try to collect the entire $90,000 and non only the $85,200.

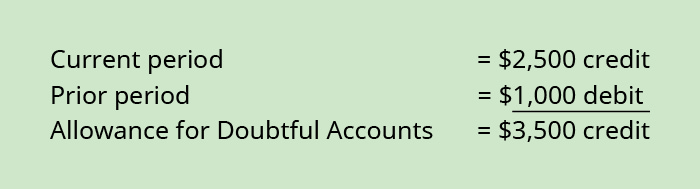

Under the remainder sheet method of calculating bad debt expenses, if at that place is already a balance in Assart for Doubtful Accounts from a previous period and accounts written off in the current year, this must be considered before the adjusting entry is fabricated. For example, if a company already had a credit residue from the prior period of $1,000, plus any accounts that accept been written off this year, and a current period estimated residuum of $2,500, the company would need to decrease the prior menses's credit balance from the current menstruum's estimated credit balance in order to calculate the corporeality to be added to the Allowance for Doubtful Accounts.

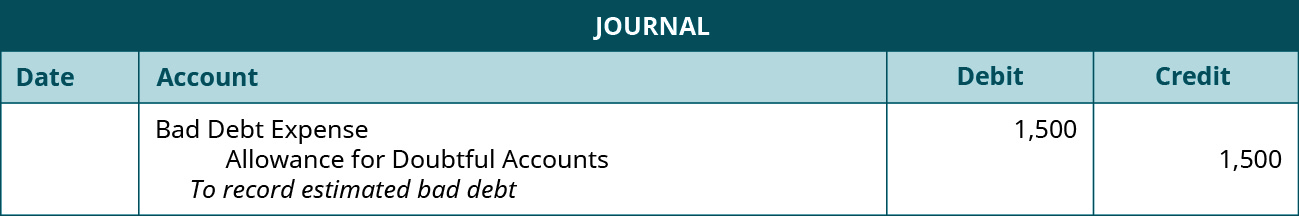

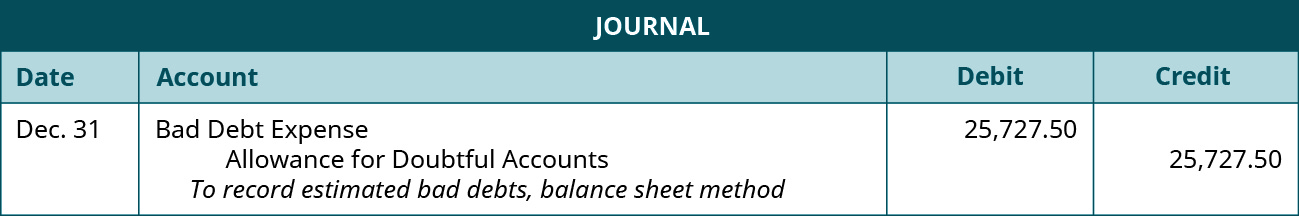

Therefore, the adjusting journal entry would be every bit follows.

If a company already had a debit balance from the prior flow of $1,000, and a current period estimated residual of $2,500, the company would need to add the prior catamenia'southward debit rest to the current period'south estimated credit balance.

Therefore, the adjusting journal entry would be as follows.

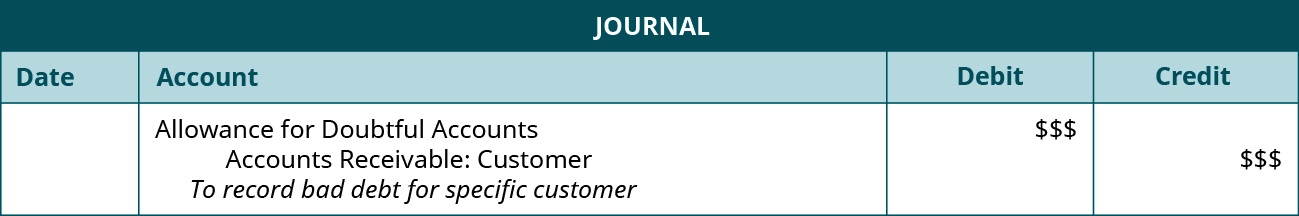

When a specific customer has been identified as an uncollectible account, the following journal entry would occur.

Assart for Doubtful Accounts decreases (debit) and Accounts Receivable for the specific customer also decreases (credit). Allowance for doubtful accounts decreases because the bad debt amount is no longer unclear. Accounts receivable decreases considering at that place is an assumption that no debt volition be nerveless on the identified customer's account.

Permit's say that the customer unexpectedly pays on the account in the hereafter. The following journal entries would occur.

The first entry reverses the previous entry where bad debt was written off. This reinstatement requires Accounts Receivable: Client to increase (debit), and Allowance for Hundred-to-one Accounts to increment (credit). The second entry records the payment on the account. Cash increases (debit) and Accounts Receivable: Client decreases (credit) for the amount received.

To compute the almost accurate estimation possible, a company may use 1 of three methods for bad debt expense recognition: the income argument method, balance sheet method, or balance sheet aging of receivables method.

Bad Debt Estimation

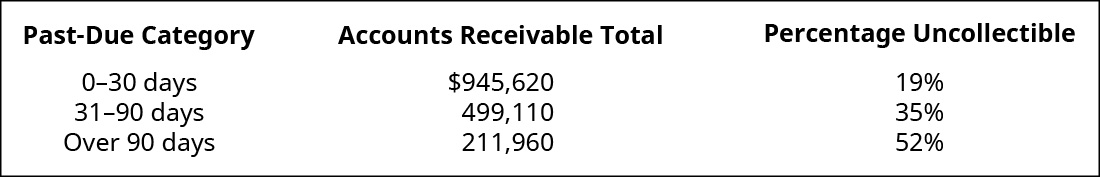

Every bit the accountant for a big publicly traded food company, you lot are considering whether or not you demand to change your bad debt estimation method. Y'all currently use the income statement method to estimate bad debt at 4.5% of credit sales. You are because switching to the balance canvas aging of receivables method. This would carve up accounts receivable into iii by- due categories and assign a percentage to each group.

While yous know that the balance sail aging of receivables method is more than accurate, it does require more company resources (e.g., time and money) that are currently practical elsewhere in the business. Using the income statement method is acceptable under mostly accustomed accounting principles (GAAP), simply should you switch to the more authentic method even if your resources are constrained? Practice y'all have a responsibleness to the public to modify methods if you know one is a better estimation?

Income Statement Method for Calculating Bad Debt Expenses

The income statement method (also known as the percentage of sales method) estimates bad debt expenses based on the assumption that at the end of the period, a sure percentage of sales during the period will not exist collected. The interpretation is typically based on credit sales only, not full sales (which include cash sales). In this example, assume that whatever credit carte sales that are uncollectible are the responsibility of the credit card visitor. It may be obvious intuitively, but, by definition, a cash sale cannot go a bad debt, bold that the cash payment did not entail apocryphal currency. The income statement method is a unproblematic method for calculating bad debt, only information technology may be more imprecise than other measures because it does not consider how long a debt has been outstanding and the role that plays in debt recovery.

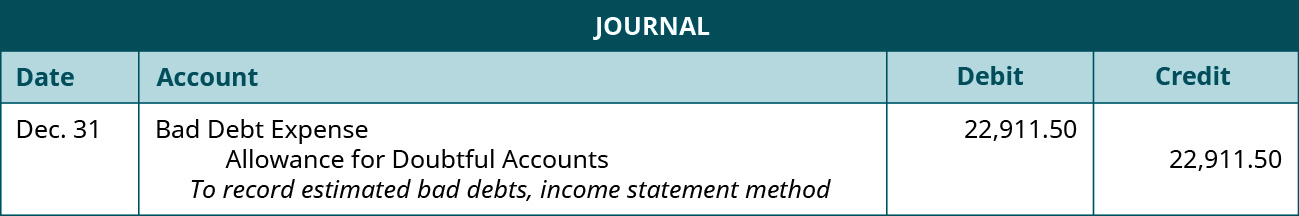

To illustrate, let'due south keep to use Billie's Watercraft Warehouse (BWW) equally the example. Billie'due south terminate-of-year credit sales totaled $458,230. BWW estimates that 5% of its overall credit sales will issue in bad debt. The post-obit adjusting journal entry for bad debt occurs.

Bad Debt Expense increases (debit), and Allowance for Hundred-to-one Accounts increases (credit) for $22,911.50 ($458,230 × 5%). This means that BWW believes $22,911.50 will exist uncollectible debt. Allow's say that on April 8, it was adamant that Customer Robert Arts and crafts's account was uncollectible in the amount of $5,000. The post-obit entry occurs.

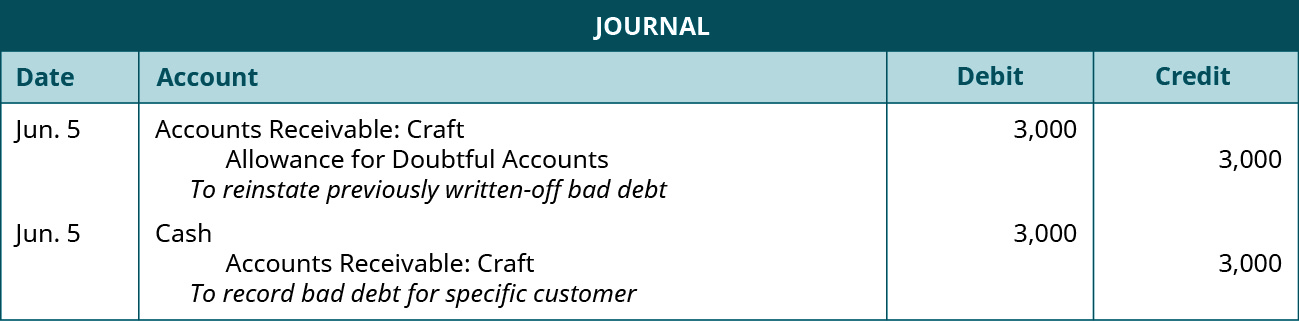

In this case, Allowance for Doubtful Accounts decreases (debit) and Accounts Receivable: Craft decreases (credit) for the known uncollectible corporeality of $5,000. On June 5, Craft unexpectedly makes a partial payment on his account in the corporeality of $iii,000. The following journal entries bear witness the reinstatement of bad debt and the subsequent payment.

The outstanding remainder of $2,000 that Craft did not repay will remain as bad debt.

Heating and Air Company

You run a successful heating and air conditioning company. Your net credit sales, accounts receivable, and allowance for doubtful accounts figures for twelvemonth-end 2018, follow.

- Compute bad debt interpretation using the income statement method, where the percent uncollectible is v%.

- Prepare the journal entry for the income argument method of bad debt estimation.

- Compute bad debt interpretation using the balance sheet method of percentage of receivables, where the percent uncollectible is nine%.

- Prepare the periodical entry for the rest canvass method bad debt estimation.

Solution

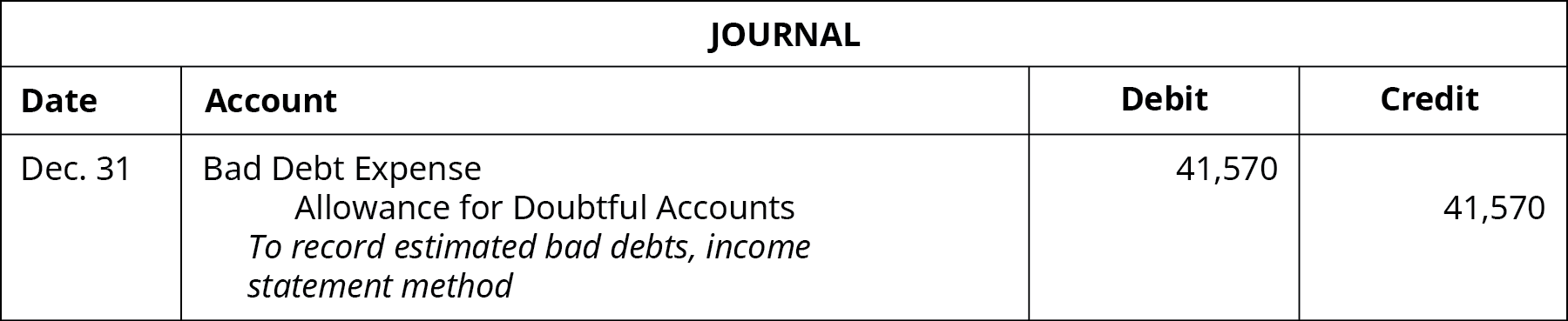

- $41,570; $831,400 × v%

-

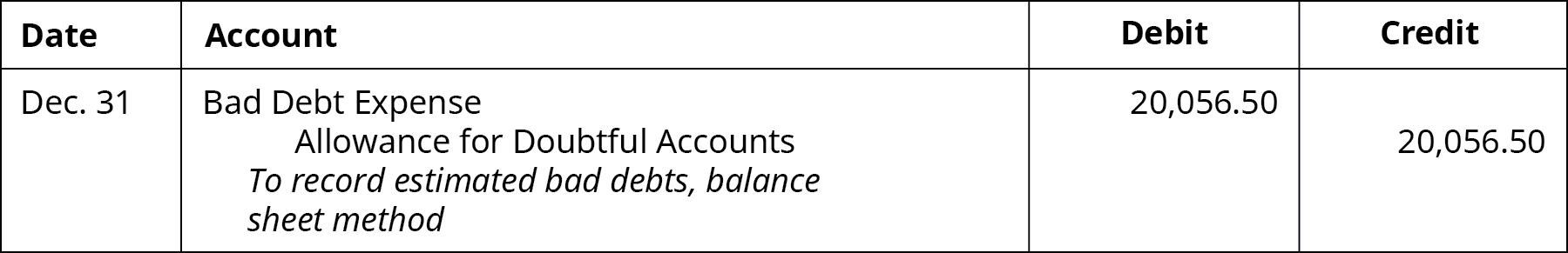

- $20,056.fifty; $222,850 × ix%

-

Balance Sheet Method for Computing Bad Debt Expenses

The residual sheet method (also known equally the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. The method looks at the balance of accounts receivable at the finish of the flow and assumes that a certain amount volition not be collected. Accounts receivable is reported on the balance sheet; thus, it is called the remainder sheet method. The balance sheet method is another simple method for computing bad debt, simply it too does non consider how long a debt has been outstanding and the role that plays in debt recovery. There is a variation on the residue sheet method, yet, called the crumbling method that does consider how long accounts receivable accept been owed, and information technology assigns a greater potential for default to those debts that have been owed for the longest period of time.

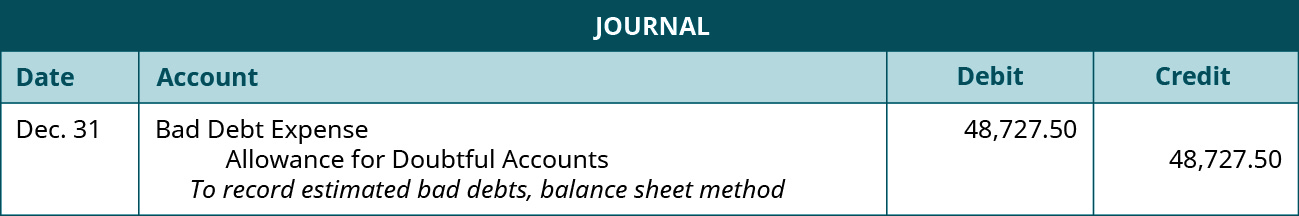

Standing our examination of the balance sheet method, assume that BWW'due south end-of-year accounts receivable balance totaled $324,850. This entry assumes a null balance in Allowance for Hundred-to-one Accounts from the prior menstruation. BWW estimates 15% of its overall accounts receivable will result in bad debt. The following adjusting periodical entry for bad debt occurs.

Bad Debt Expense increases (debit), and Assart for Doubtful Accounts increases (credit) for $48,727.50 ($324,850 × 15%). This means that BWW believes $48,727.50 will be uncollectible debt. Let'southward consider that BWW had a $23,000 credit remainder from the previous menses. The adjusting journal entry would recognize the following.

This is unlike from the concluding journal entry, where bad debt was estimated at $48,727.50. That journal entry causeless a zero balance in Allowance for Doubtful Accounts from the prior period. This journal entry takes into account a credit balance of $23,000 and subtracts the prior menses'due south balance from the estimated residual in the current period of $48,727.l.

Remainder Canvass Aging of Receivables Method for Computing Bad Debt Expenses

The residual sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, only it also considers the uncollectible fourth dimension menstruum for each account. The longer the time passes with a receivable unpaid, the lower the probability that it will become collected. An account that is 90 days overdue is more likely to exist unpaid than an business relationship that is 30 days past due.

With this method, accounts receivable is organized into categories past length of time outstanding, and an uncollectible per centum is assigned to each category. The length of uncollectible time increases the percentage assigned. For example, a category might consist of accounts receivable that is 0–xxx days past due and is assigned an uncollectible percentage of 6%. Another category might be 31–60 days by due and is assigned an uncollectible percentage of 15%. All categories of estimated uncollectible amounts are summed to get a full estimated uncollectible residual. That full is reported in Bad Debt Expense and Allowance for Doubtful Accounts, if there is no carryover balance from a prior menstruum. If at that place is a carryover balance, that must exist considered before recording Bad Debt Expense. The balance sheet crumbling of receivables method is more complicated than the other 2 methods, but it tends to produce more accurate results. This is because it considers the corporeality of time that accounts receivable has been owed, and information technology assumes that the longer the time owed, the greater the possibility that private accounts receivable will prove to exist uncollectible.

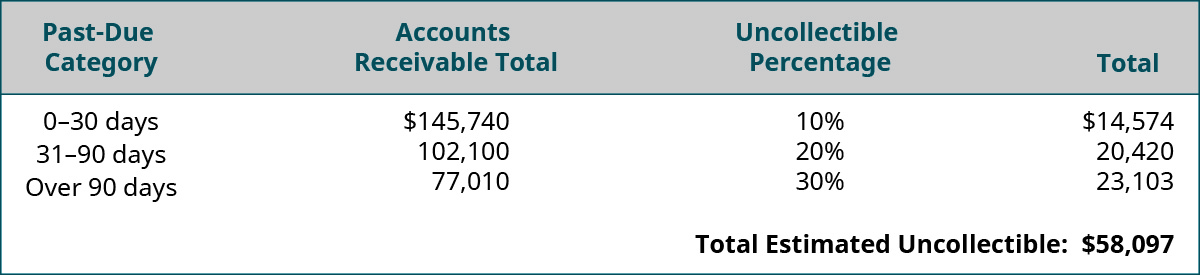

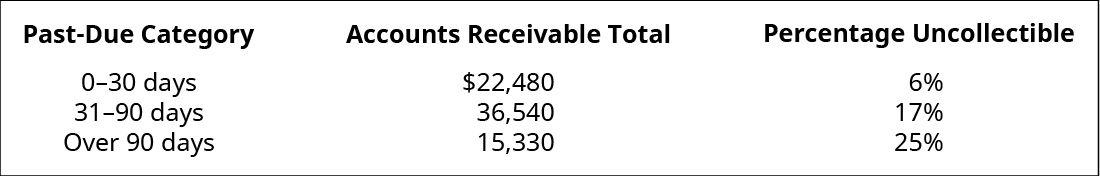

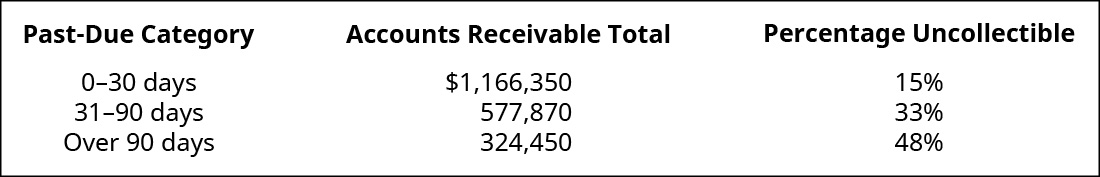

Looking at BWW, it has an accounts receivable rest of $324,850 at the end of the year. The company splits its past-due accounts into three categories: 0–xxx days by due, 31–ninety days past due, and over ninety days past due. The uncollectible percentages and the accounts receivable breakdown are shown here.

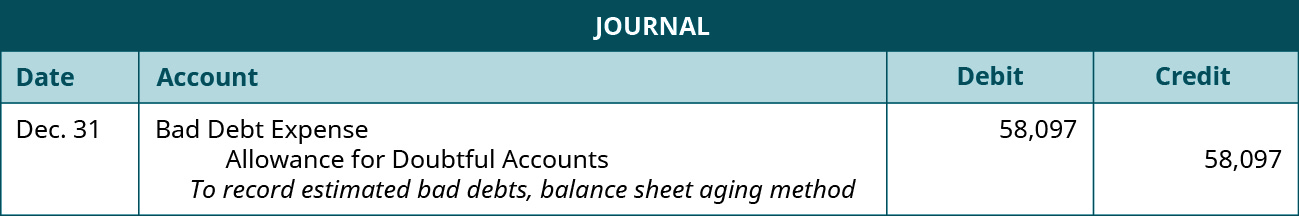

For each of the private categories, the accountant multiplies the uncollectible percentage by the accounts receivable full for that category to go the total balance of estimated accounts that will testify to be uncollectible for that category. And so all of the category estimates are added together to get one total estimated uncollectible residue for the period. The entry for bad debt would be every bit follows, if at that place was no carryover rest from the prior flow.

Bad Debt Expense increases (debit) as does Allowance for Doubtful Accounts (credit) for $58,097. BWW believes that $58,097 will exist uncollectible debt.

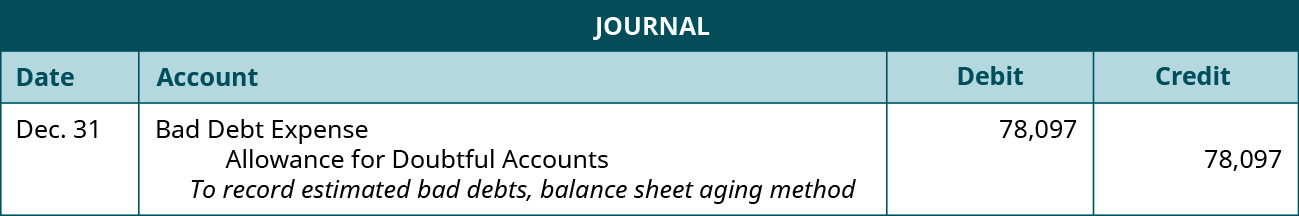

Let'southward consider a state of affairs where BWW had a $xx,000 debit balance from the previous menses. The adjusting periodical entry would recognize the following.

This is different from the last periodical entry, where bad debt was estimated at $58,097. That journal entry assumed a zip residuum in Allowance for Doubtful Accounts from the prior menses. This journal entry takes into account a debit balance of $20,000 and adds the prior catamenia's balance to the estimated rest of $58,097 in the current period.

You may notice that all iii methods apply the same accounts for the adjusting entry; but the method changes the financial outcome. Also note that information technology is a requirement that the interpretation method be disclosed in the notes of financial statements so stakeholders tin make informed decisions.

More often than not Accepted Accounting Principles

Every bit of January 1, 2018, GAAP requires a modify in how wellness-care entities record bad debt expense. Before this alter, these entities would record revenues for billed services, fifty-fifty if they did non expect to collect any payment from the patient. This uncollectible amount would so be reported in Bad Debt Expense. Nether the new guidance, the bad debt amount may only be recorded if in that location is an unexpected circumstance that prevented the patient from paying the neb, and it may only be calculated from the amount that the providing entity anticipated collecting.

For example, a patient receives medical services at a local hospital that cost $1,000. The hospital knows in advance that the patient will pay only $100 of the amount owed. The previous GAAP rules would allow the company to write off $900 to bad debt. Under the current rule, the company may only consider revenue to be the expected corporeality of $100. For example, if the patient ran into an unexpected job loss and is able to pay merely $xx of the $100 expected, the hospital would tape the $20 to revenue and the $lxxx ($100 – $20) every bit a write-off to bad debt. This is a significant modify in acquirement reporting and bad debt expense. Health-care entities volition more than than likely see a decrease in bad debt expense and revenues every bit a result of this change.1

Summary

- Bad debt is a result of unpaid and uncollectible client accounts. Companies are required to record bad debt on fiscal statements every bit expenses.

- The direct write-off method records bad debt simply when the due engagement has passed for a known amount. Bad Debt Expense increases (debit) and Accounts Receivable decreases (credit) for the amount uncollectible.

- The assart method estimates uncollectible bad debt and matches the expense in the current period to revenues generated. There are iii ways to calculate this estimation: the income statement method, balance canvass method/percent of receivables, and residue sheet aging of receivables method.

- The income argument method estimates bad debt based on a percentage of credit sales. Bad Debt Expense increases (debit) and Allowance for Doubtful Accounts increases (credit) for the amount estimated every bit uncollectible.

- The residuum sheet method estimates bad debt based on a percent of outstanding accounts receivable. Bad Debt Expense increases (debit) and Allowance for Doubtful Accounts increases (credit) for the amount estimated as uncollectible.

- The balance sheet crumbling of receivables method estimates bad debt based on outstanding accounts receivable, but information technology considers the time menses that an business relationship is past due. Bad Debt Expense increases (debit) and Allowance for Doubtful Accounts increases (credit) for the corporeality estimated as uncollectible.

Multiple Choice

(Effigy)Tines Commerce computes bad debt based on the allowance method. They make up one's mind their current twelvemonth's balance interpretation to exist a credit of $45,000. The previous period had a credit balance in Allowance for Hundred-to-one Accounts of $12,000. What should be the reported figure in the adjusting entry for the electric current period?

- $12,000

- $45,000

- $33,000

- $57,000

(Figure)Doer Visitor reports year-stop credit sales in the amount of $390,000 and accounts receivable of $85,500. Doer uses the income argument method to report bad debt estimation. The interpretation per centum is 3.5%. What is the estimated balance uncollectible using the income statement method?

- $xiii,650

- $2,992.50

- $136,500

- $29,925

(Figure)Balloons Plus computes bad debt based on the assart method. They make up one's mind their current twelvemonth'southward balance estimation to be a credit of $84,000. The previous catamenia had a credit residuum in Assart for Doubtful Accounts of $26,000. What should be the reported effigy in the adjusting entry for the electric current period?

- $84,000

- $58,000

- $26,000

- $110,000

(Figure)Conner Pride reports year-end credit sales in the amount of $567,000 and accounts receivable of $134,000. Conner uses the balance sheet method to study bad debt estimation. The interpretation percentage is 4.six%. What is the estimated balance uncollectible using the balance sheet method?

- $26,082

- $6,164

- $260,820

- $61,640

(Effigy)Which method delays recognition of bad debt until the specific customer accounts receivable is identified?

- income statement method

- balance canvas method

- directly write-off method

- allowance method

(Figure)Which of the post-obit estimation methods considers the amount of time past due when computing bad debt?

- balance sheet method

- straight write-off method

- income statement method

- residue sheet crumbling of receivables method

Questions

(Figure)Which account blazon is used to record bad debt interpretation and is a contra account to Accounts Receivable?

Allowance for Doubtful Accounts

(Effigy)Earrings Depot records bad debt using the allowance, balance sheet method. They recorded $97,440 in accounts receivable for the yr and $288,550 in credit sales. The uncollectible percentage is 5.five%. What is the bad debt interpretation for the year using the balance sheet method?

(Effigy)Racing Adventures records bad debt using the allowance, income statement method. They recorded $134,560 in accounts receivable for the year and $323,660 in credit sales. The uncollectible percentage is 6.eight%. What is the bad debt estimation for the twelvemonth using the income statement method?

$22,008.88; $323,660 × six.eight%

(Figure)Aron Larson is a customer of Bank Enterprises. Mr. Larson took out a loan in the amount of $120,000 on August i. On Dec 31, Bank Enterprises uses the assart method and determines the loan to be uncollectible. Larson had not paid annihilation toward the rest due on account. What is the journal entry recording the bad debt write-off?

(Figure)The following accounts receivable information pertains to Growth Markets LLC.

What is the total uncollectible estimated bad debt for Growth Markets LLC?

$xi,393.10; ($22,480 × 6%) + ($36,540 × 17%) + ($fifteen,330 × 25%)

Exercise Set A

(Effigy)Window World extended credit to client Nile Jenkins in the corporeality of $130,900 for his buy of window treatments on April 2. Terms of the sale are n/150. The price of the buy to Window World is $56,200. On September 4, Window Earth determined that Nile Jenkins'due south account was uncollectible and wrote off the debt. On December 3, Mr. Jenkins unexpectedly paid in full on his account. Record each Window Earth transaction with Nile Jenkins. In order to demonstrate the write-off and so subsequent collection of an business relationship receivable, assume in this example that Window World rarely extends credit directly, so this transaction is permitted to use the directly write-off method. Call back, however, that in most cases the directly write-off method is not allowed.

(Figure)Millennium Associates records bad debt using the assart, income statement method. They recorded $299,420 in accounts receivable for the yr, and $773,270 in credit sales. The uncollectible percentage is 3.ii%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the corporeality of $1,330. On April fifteen, Molar Corp unexpectedly pays its account in full. Record journal entries for the following.

- Year-cease adjusting entry for 2017 bad debt

- February five, 2018 identification entry

- Entry for payment on April 15, 2018

(Figure)Millennium Associates records bad debt using the allowance, balance sheet method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.two%. On November 22, Millennium Assembly identifies one uncollectible business relationship from Angel's Hardware in the amount of $3,650. On December eighteen, Angel's Hardware unexpectedly pays its account in full. Record journal entries for the following.

- Year-end adjusting entry for 2017 bad debt

- November 22, 2018 identification entry

- Entry for payment on December 18, 2018

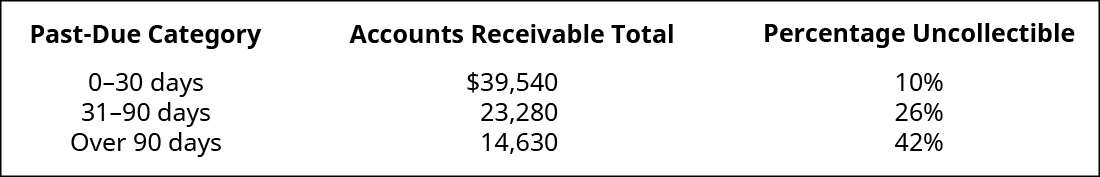

(Figure)The following accounts receivable data pertains to Marshall Inc.

Determine the estimated uncollectible bad debt from Marshall Inc. using the balance sail aging of receivables method, and record the twelvemonth-finish adjusting periodical entry for bad debt.

Exercise Gear up B

(Figure)Laminate Limited extended credit to customer Amal Sunderland in the amount of $244,650 for his January 4 purchase of flooring. Terms of the sale are ii/30, n/120. The cost of the purchase to Laminate Express is $88,440. On Apr 5, Laminate Express determined that Amal Sunderland's business relationship was uncollectible and wrote off the debt. On June 22, Amal Sunderland unexpectedly paid thirty% of the total corporeality due in greenbacks on his account. Tape each Laminate Express transaction with Amal Sunderland. In society to demonstrate the write-off and then subsequent collection of an business relationship receivable, presume in this example that Laminate Limited rarely extends credit directly, so this transaction is permitted to employ the direct write-off method. Remember, though, that in most cases the directly write-off method is not allowed.

(Figure)Olena Mirrors records bad debt using the allowance, income statement method. They recorded $343,160 in accounts receivable for the year and $577,930 in credit sales. The uncollectible percentage is 4.4%. On May 10, Olena Mirrors identifies one uncollectible account from Elsa Sweeney in the corporeality of $two,870. On August 12, Elsa Sweeney unexpectedly pays $one,441 toward her account. Record periodical entries for the following.

- Year-stop adjusting entry for 2017 bad debt

- May 10, 2018 identification entry

- Entry for payment on August 12, 2018

(Effigy)Olena Mirrors records bad debt using the allowance, rest sheet method. They recorded $343,160 in accounts receivable for the yr and $577,930 in credit sales. The uncollectible percentage is iv.4%. On June 11, Olena Mirrors identifies 1 uncollectible account from Nadia White in the amount of $iv,265. On September fourteen, Nadia Chernoff unexpectedly pays $one,732 toward her account. Record journal entries for the following.

- Year-end adjusting entry for 2017 bad debt

- June eleven, 2018 identification entry

- Entry for payment on September 14, 2018

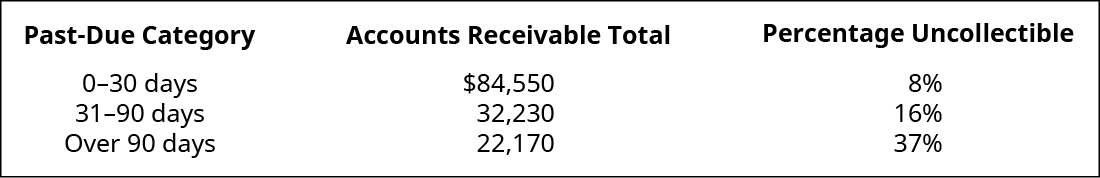

(Figure)The post-obit accounts receivable information pertains to Envelope Experts.

Determine the estimated uncollectible bad debt from Envelope Experts using the balance sheet aging of receivables method, and record the year-stop adjusting journal entry for bad debt.

Problem-Ready-A

(Figure)Jars Plus recorded $861,430 in credit sales for the yr and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.vi% for the balance sheet method.

- Record the yr-end adjusting entry for 2018 bad debt using the income statement method.

- Record the year-end adjusting entry for 2018 bad debt using the residuum canvas method.

- Assume at that place was a previous debit balance in Allowance for Doubtful Accounts of $ten,220, record the twelvemonth-end entry for bad debt using the income argument method, then the entry using the residue canvass method.

- Presume at that place was a previous credit remainder in Assart for Hundred-to-one Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and and then the entry using the balance sheet method.

(Figure)The post-obit accounts receivable information pertains to Luxury Cruises.

- Determine the estimated uncollectible bad debt for Luxury Cruises in 2018 using the residue sheet aging of receivables method.

- Record the year-end 2018 adjusting journal entry for bad debt.

- Assume in that location was a previous debit remainder in Allowance for Doubtful Accounts of $187,450; record the year-end entry for bad debt, taking this into consideration.

- Assume there was a previous credit balance in Allowance for Hundred-to-one Accounts of $206,770; record the yr-finish entry for bad debt, taking this into consideration.

- On January 24, 2019, Luxury Cruises identifies Landon Walker's business relationship as uncollectible in the amount of $4,650. Record the entry for identification.

(Effigy)Funnel Direct recorded $ane,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percent is 4.4% for the income statement method and 4% for the residue sheet method.

- Record the year-end adjusting entry for 2018 bad debt using the income argument method.

- Tape the twelvemonth-finish adjusting entry for 2018 bad debt using the rest canvas method.

- Assume at that place was a previous credit balance in Allowance for Doubtful Accounts of $xiii,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.

Problem-Set-B

(Effigy)Bristax Corporation recorded $ane,385,660 in credit sales for the twelvemonth, and $732,410 in accounts receivable. The uncollectible percentage is iii.1% for the income statement method and 4.5% for the residue sheet method.

- Record the year-end adjusting entry for 2018 bad debt using the income statement method.

- Record the yr-terminate adjusting entry for 2018 bad debt using the balance sheet method.

- Assume in that location was a previous debit balance in Assart for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and and then the entry using the balance canvass method.

- Assume there was a previous credit balance in Allowance for Hundred-to-one Accounts of $17,430; tape the year-end entry for bad debt using the income statement method, then the entry using the residue sheet method.

(Effigy)The following accounts receivable information pertains to Select Distributors.

- Determine the estimated uncollectible bad debt for Select Distributors in 2018 using the remainder sheet aging of receivables method.

- Record the twelvemonth-end 2018 adjusting journal entry for bad debt.

- Assume there was a previous debit balance in Allowance for Doubtful Accounts of $233,180; tape the year-end entry for bad debt, taking this into consideration.

- Assume in that location was a previous credit rest in Assart for Doubtful Accounts of $199,440; tape the year-end entry for bad debt, taking this into consideration.

- On March 21, 2019, Select Distributors identifies Aida Norman's account as uncollectible in the corporeality of $10,890. Tape the entry for identification.

(Figure)Ink Records recorded $2,333,898 in credit sales for the year and $ane,466,990 in accounts receivable. The uncollectible pct is iii% for the income statement method and five% for the balance canvas method.

- Tape the year-stop adjusting entry for 2018 bad debt using the income statement method.

- Tape the yr-terminate adjusting entry for 2018 bad debt using the balance sail method.

- Assume there was a previous credit balance in Assart for Hundred-to-one Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.

Thought Provokers

(Effigy)You run an office supplies chain. You must determine the nearly appropriate bad debt interpretation method to utilize for financial statement reporting. Your choices are the income statement, residue sail, and residue sheet aging of receivables methods.

- Enquiry a real competitor in your manufacture and make up one's mind which method the competitor selected. Give a detailed description of the method used and any supporting calculations.

- Create a hypothetical credit auction, an accounts receivable figure for your business, and compute the bad debt interpretation using the competitor's method.

- Create the periodical entry to tape bad debt.

- Compute bad debt using the other two methods and bear witness the journal entry for each.

- What are the benefits and challenges for all of these methods?

- Which method would y'all cull for your business? Explain why.

Footnotes

- i Tara Bannow. "New Bad Debt Accounting Standards Probable to Remake Community Benefit Reporting." Modern Healthcare. March 17, 2018. http://world wide web.modernhealthcare.com/article/20180317/NEWS/180319904

Glossary

- assart for doubtful accounts

- contra nugget account that is specifically contrary to accounts receivable; information technology is used to estimate bad debt when the specific client is unknown

- assart method

- estimates bad debt during a flow based on certain computational approaches, and it matches this to sales

- bad debts

- uncollectible amounts from customer accounts

- balance sheet aging of receivables method

- allowance method arroyo that estimates bad debt expenses based on the residue in accounts receivable, but it besides considers the uncollectible time flow for each business relationship

- residual sheet method

- (also, percentage of accounts receivable method) allowance method approach that estimates bad debt expenses based on the rest in accounts receivable

- contra account

- account paired with another account type that has an opposite normal balance to the paired business relationship; reduces or increases the balance in the paired account at the end of a period

- direct write-off method

- delays recognition of bad debt until the specific customer accounts receivable is identified

- income argument method

- allowance method arroyo that estimates bad debt expenses based on the supposition that at the end of the catamenia, a certain pct of sales during the period will non be collected

- net realizable value

- amount of an account residue that is expected to be collected; for case, if a company has a residual of $10,000 in accounts receivable and a $300 balance in the allowance for doubtful accounts, the cyberspace realizable value is $9,700

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/account-for-uncollectible-accounts-using-the-balance-sheet-and-income-statement-approaches/#:~:text=Bad%20Debt%20Expense%20increases%20(debit)%20and%20Allowance%20for%20Doubtful%20Accounts,the%20amount%20estimated%20as%20uncollectible.

0 Response to "what adjustment is made to record the estimated expense for uncollectible accounts?"

Post a Comment